A Vice President of Imani Africa Bright Simons has described the agreement between the government of Ghana and the Ghana Insurers Association regarding the dept exchange participation as landmark.

In a tweet, Mr Simons said “In a spectacular breakthrough, the government of Ghana reaches landmark deal with insurance firms, further increasing the debt exchange participation rate and the overall debt and liquidity relief. However, this is on the basis of access to a Fund that so far has limited prospects.”

Under the agreement, insurance companies will participate in the exchange on similar terms as the banks, a joint statement issued by the Ministry of Finance and the Insurers Association said on Thursday, January 26.

“The government through the solvency window of the Ghana Financial Stability Fund (GFSF) will provide support for the insurance companies that are seriously affected by the DDEP.’

“The objective is to protect jobs and the stability of the Industry,” the statement said.

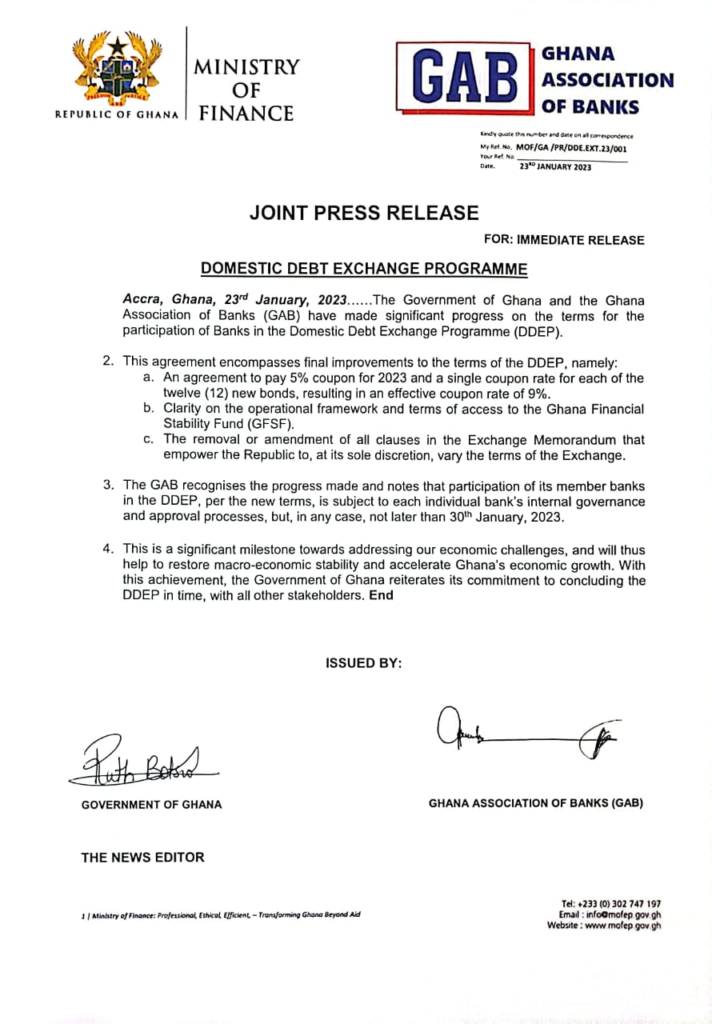

Last week, the Government and the Ghana Association of Bankers (GAB) also reached an agreement on the new terms for the Domestic Debt Exchange programme.

Earlier, the banks rejected the programme as announced by the government.

The GAB directed commercial banks not to sign onto the amended debt exchange offer over uncertainty surrounding the impact of the debt restructuring on the banking industry.

The association wants its concerns addressed before accepting the debt exchange offer, according to a letter sent to managing directors of banks and seen by 3Business. GAB told member banks that may want to consider the debt exchange in its current form to formally inform the association first before doing so.

“…From the uncertainty surrounding the programme, GAB recommends that all banks must stay any further movement on the exchange until our demands have been met. However, in the event that a bank may have to move forward to exchange, the MD/CEO must inform the CEO of GAB directly of the decision,” according to the letter sent to the banks.”

However, after an engagement with the Ministry of Finance, the Association of Banks that per the new terms, the participation of member banks is subjected to individual bank’s internal governance and approval processes.

“This is a significant milestone towards addressing our economic challenges, and will thus help to restore macro-economic stability and accelerate Ghana’s economic growth.

“With this achievement, the Government of Ghana reiterates its commitment to concluding the DDEP in time with all other stakeholders,” a joint statement from the Finance Ministry and GAB noted.

Source:3news.com

News, Politics , Sports, Business, Entertainment, World,Lifestyle, Technology , Tourism, Gh Songs | News, Politics , Sports, Business, Entertainment, World,Lifestyle, Technology , Tourism, Gh Songs |

News, Politics , Sports, Business, Entertainment, World,Lifestyle, Technology , Tourism, Gh Songs | News, Politics , Sports, Business, Entertainment, World,Lifestyle, Technology , Tourism, Gh Songs |